SafetyWing: A Review of an Upstart Travel Insurance Company

Budget travelers love saving money — myself included. But one of the expenses that we shouldn’t be cheap with is travel insurance.

After over 15 years of traveling the world, I still never leave home without it.

Why?

Because I’ve seen firsthand how useful it can be — and how much money it can save.

I’ve lost baggage, had my camera broken, and even needed emergency medical help over the years.

Travel insurance has been there for me each time. Not only has it saved me money but it’s provided me with peace of mind as I explore.

I’ve written extensively over the years about why you need insurance, how to pick the right company, and listed my preferred providers.

Today, I want to talk about my favorite travel insurance company: SafetyWing.

Table of Contents

Who is SafetyWing?

In 2018, a new insurance company emerged: SafetyWing. It is a fully remote Norwegian start-up based in California that focuses on coverage for budget travelers and digital nomads (though you don’t have to be either to get coverage). It is run by nomads and expats who know exactly what such travelers need.

SafetyWing offers basic insurance plans (called “Nomad Insurance”) for a fraction of what other companies charge, although they are also less comprehensive. To me, they are the best overall travel insurance company out there.

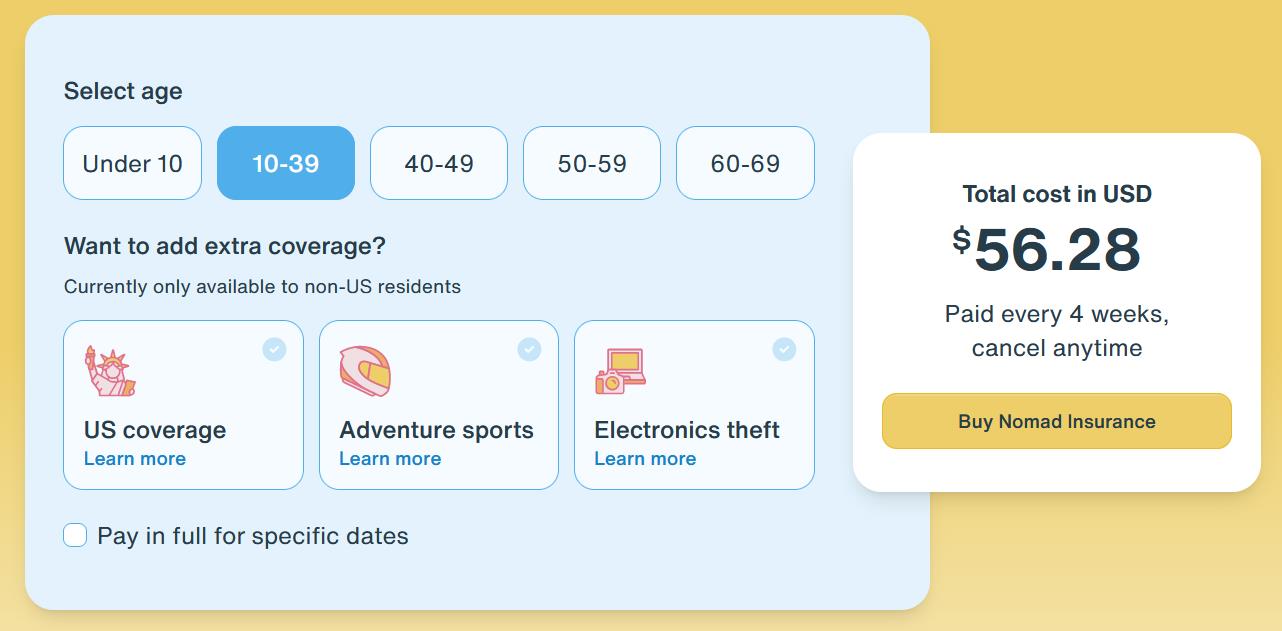

Their standard Nomad Insurance coverage costs just $56.28 USD for 4 weeks (for travelers aged 10-39). That’s one of the lowest prices out there for reliable travel insurance.

Up until 2024, they also charged a $250 USD deductible when you make a claim. This deductible is no longer charged, which makes SafetyWing even more affordable!

Their coverage extends all the way to age 69, however, travelers aged 60-69 should expect to pay upwards of $196 USD per month for coverage.

But is the coverage actually good? What about the customer service?

Today I want to review Safety Wing and talk about when it is — and isn’t — worth using so you can better prepare for your next trip and ensure you have the coverage you need.

What Does SafetyWing Cover?

SafetyWing’s standard Nomad Insurance plan is the “Nomad” plan. It’s just $56.28 USD for four weeks of travel (outside the US). That works out to just $1.87 USD per day.

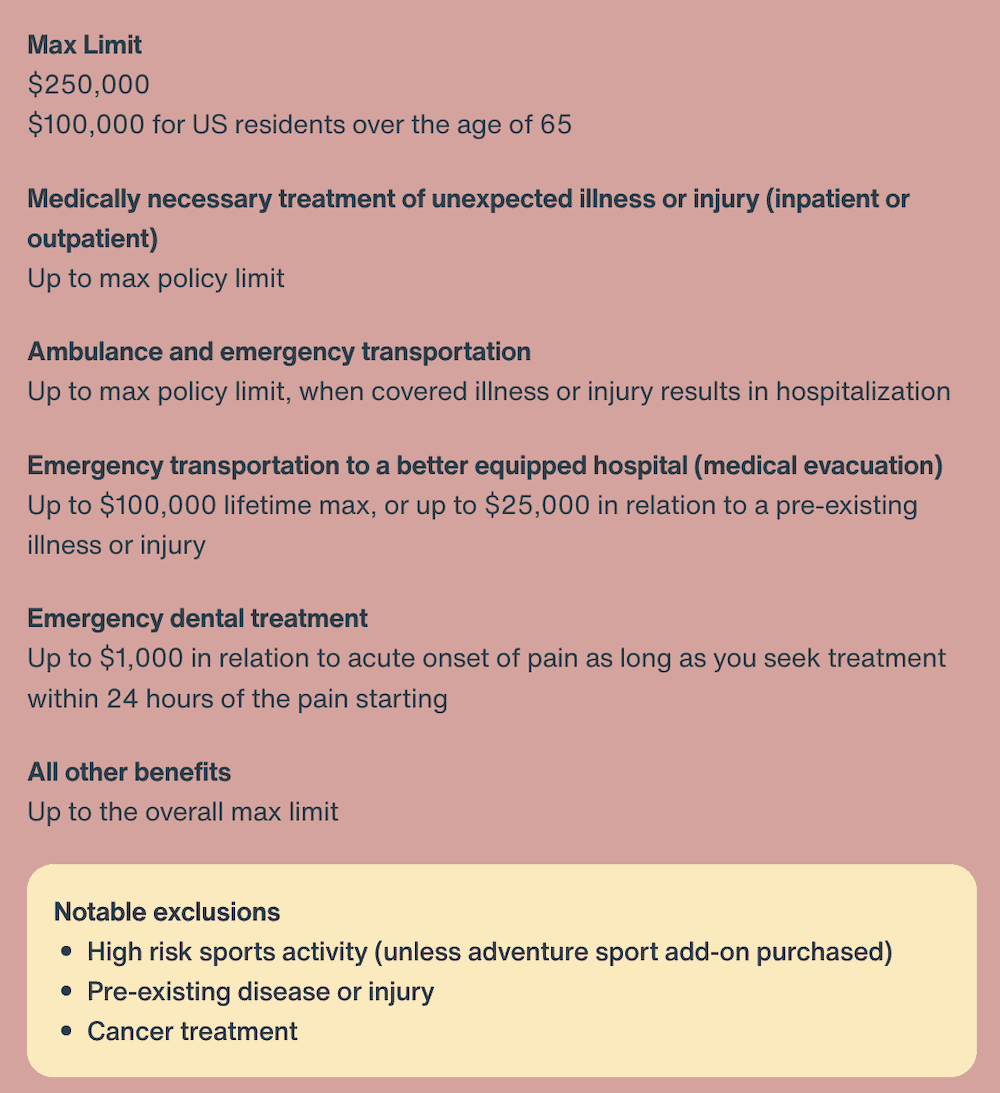

For travelers under age 64, that plan includes the following:

- $250,000 USD in emergency medical coverage

- $1,000 USD for emergency dental care

- $100,000 USD for medical evacuation ($25,000 USD if the cause of medical evacuation is acute onset of pre-existing condition)

- $10,000 USD for an evacuation due to political upheaval

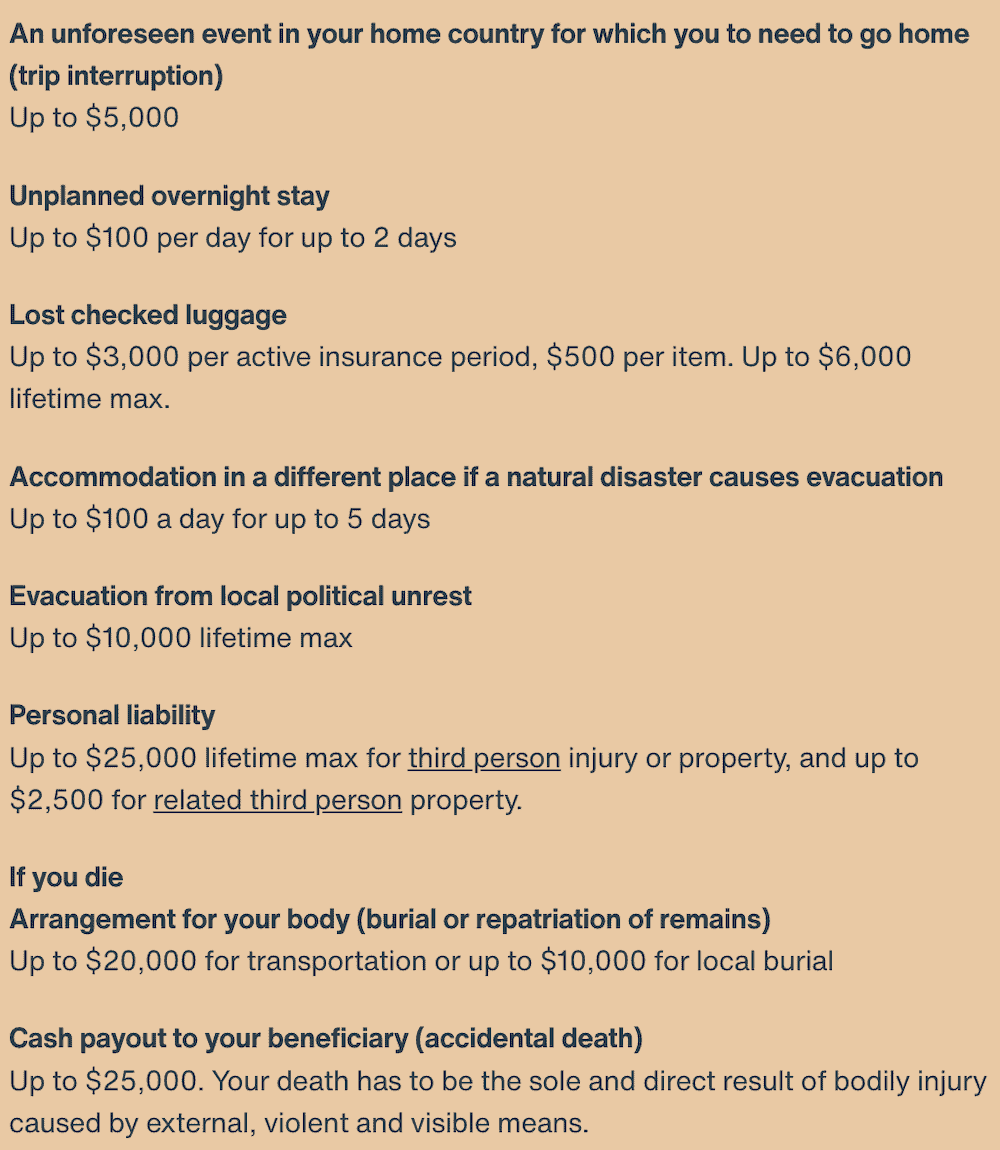

- $5,000 USD for a trip interruption

- Up to $100 a day after a 12-hour delay period requiring an unplanned overnight stay. Subject to a maximum of 2 days.

- $12,500–25,000 USD for death or dismemberment

- $20,000 USD for repatriation of remains

Be sure to check the description of coverage for any conditions that apply.

SafetyWing covers the basics. Its $100,000 USD for medical evacuation is on the low end, but unless you’re heading out into the remote wilderness, that should be fine. (If you want higher coverage, get MedJet.)

Moreover, its travel-delay payout is pretty low, but airlines and most travel credit cards provide travel delay assistance too so you might not even need the coverage offered by SafetyWing. Additionally, it doesn’t really cover expensive electronics, which sucks if you have a pricey camera or video gear.

As with most standard travel insurance plans, this one doesn’t include pre-existing conditions or certain adventure sports, so it’s not a good policy if you’re going to do a lot of adventure activities on the road.

(Note: if you’re not a US resident, there are now both electronics and adventure add-ons, adding coverage in both of these areas. Hopefully they add this for US residents soon!)

You can read their description of coverage here.

What’s Not Covered?

Nomad Insurance is primarily geared towards covering medical emergencies and basic travel mishaps (like delays and lost luggage). Here are some things that aren’t covered:

- Alcohol- or drug-related incidents.

- Extreme sports & adventure activities (unless you purchase the adventure sports add-on, which is available for non-US residents)

- Pre-existing conditions or general check-ups

- Trip cancellation

- Lost or stolen cash

Nomad Health: Coverage for Digital Nomads and Long-Term Travelers

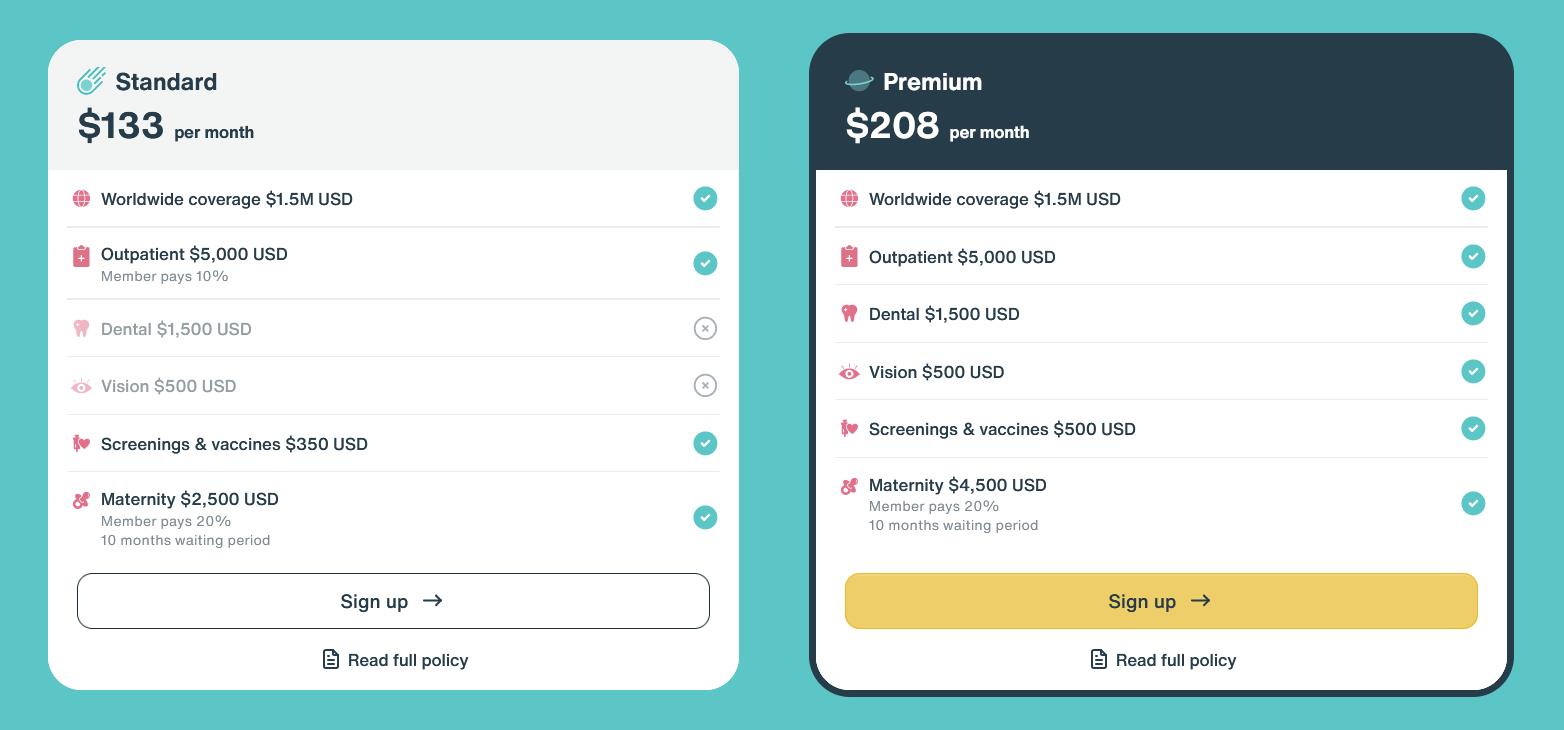

In 2023, SafetyWing launched Nomad Health. It’s insurance for digital nomads, remote workers, and long-term travelers. This new plan offers a mix of the standard emergency coverage that we’ve been discussing above along with “regular” health care coverage, such as routine visits and preventive care.

Nomad Health also offers coverage in 175 countries, includes wellness benefits, mental health care, and the ability for individuals choose their own doctor while traveling.

It’s like the kind of health insurance you’d find in your home country, ensuring that you’re looked after no matter what happens while you’re abroad.

You can learn more and compare the plans here.

If you’re just heading out for a couple weeks or a couple months, SafetyWing’s Nomad Insurance is the option for you. It’s perfect for emergencies, is super affordable, and is designed for budget travelers.

However, if you’re going to be working abroad or traveling for months (or years), then their new Nomad Health plan is the better option. It offers much more coverage while still being affordable (prices start at $133 USD per month). In fact, it’s the plan I wish I had when I started traveling!

You can learn more about Nomad Health in my dedicated review.

Making a Claim

SafetyWing makes it easy to file a claim through their online portal. You just upload all the required documents, screenshots, and photos, and wait to hear back. While claims can take up to 45 business days, most are handled in less than a week (as of writing, the average wait time is four days).

If you read the reviews online, most people who had a negative experience either didn’t know about the deductible (SafetyWing has since removed their deductible for non-US residents as of 2024) or hated the length of time it took to get paid. But that’s pretty normal for people to complain about.

On the plus side, as of 2024, SafetyWing’s average time to handle a claim is down to just four days. That’s way faster than most companies!

A Note About COVID

SafetyWing does include coverage for COVID-19. As long as the virus was not contracted before your plan starts, then it will be covered (as long as it is medically necessary).

SafetyWing also covers quarantine costs (outside your home country) for up to $50 USD/day for 10 days (provided that you’ve had your plan for at least 28 days).

Pros and Cons of SafetyWing

Here’s a look that the pros and cons of SafetyWing at a glance to help you decide if it’s the best insurance provider for you and your trip:

on your trip

medical coverage for 30 days in your home

country (15 days if you’re from the U.S.)

(1 per adult) can be included for free

renews every 4 weeks)

Who is SafetyWing Good — and Not Good For?

SafetyWing is designed as mainly medical coverage. Since SafetyWing is designed for the budget-conscious digital nomad, it doesn’t cover some areas that might be more of a priority for a shorter-term traveler. Here’s a quick chart to help you decide if SafetyWing is right for you:

or cancellation

for long-term travel

Travel insurance is something I never leave home without. I know it’s a boring topic to read about and research, but it can literally save you hundreds or thousands of dollars in bills! I never, ever leave home without it. You shouldn’t either.

So, the next time, you’re on the road, consider SafetyWing. To me, they are the best travel insurance company out there for budget travelers.

You can use the booking widget below to get a quote (it’s free):

For a comparison with other travel insurance companies, check out this post that lists my five favorite travel insurance companies, along with their pros and cons.

Book Your Trip: Logistical Tips and Tricks

Book Your Flight

Find a cheap flight by using Skyscanner. It’s my favorite search engine because it searches websites and airlines around the globe so you always know no stone is being left unturned.

Book Your Accommodation

You can book your hostel with Hostelworld. If you want to stay somewhere other than a hostel, use Booking.com as it consistently returns the cheapest rates for guesthouses and hotels.

Don’t Forget Travel Insurance

Travel insurance will protect you against illness, injury, theft, and cancellations. It’s comprehensive protection in case anything goes wrong. I never go on a trip without it as I’ve had to use it many times in the past. My favorite companies that offer the best service and value are:

- SafetyWing (best for everyone)

- InsureMyTrip (for those 70 and over)

- Medjet (for additional evacuation coverage)

Want to Travel for Free?

Travel credit cards allow you to earn points that can be redeemed for free flights and accommodation — all without any extra spending. Check out my guide to picking the right card and my current favorites to get started and see the latest best deals.

Need Help Finding Activities for Your Trip?

Get Your Guide is a huge online marketplace where you can find cool walking tours, fun excursions, skip-the-line tickets, private guides, and more.

Ready to Book Your Trip?

Check out my resource page for the best companies to use when you travel. I list all the ones I use when I travel. They are the best in class and you can’t go wrong using them on your trip.